Using Quintiles for Configuration of Investment Strategies

Using Quintiles for Configuration of Investment Strategies

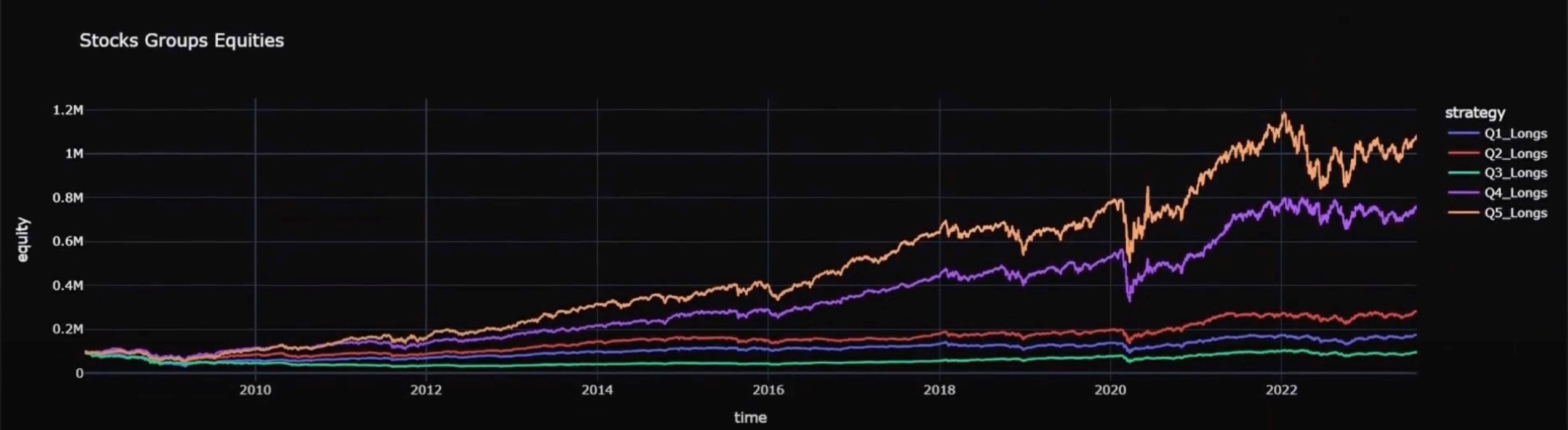

The article, part of our “Configuration of Investment Strategies” series, introduces the concept of Stock Group Quintiles as applied within our StockPicker configurator. We’ve included a straightforward visual representation to succinctly summarize the performance of different groups of stocks, ranging from the top-performing to the weakest.

What are the quantiles that are being used for the Configuration of Investment Strategies?

Quintiles are a statistical concept that entails the division of a dataset or population into five equal parts, each of which represents 20% of the total. These segments are often referred to as “quintiles” due to their quintessential nature, totaling five in number. Quintiles serve as a method to assess and compare data by categorizing it into five distinct sections, providing enhanced insight into the distribution of values within the dataset.

In our specific scenario used in this series of articles, we are dealing with a pool of nearly 100 stock components. A machine learning model employs a quantitative methodology to assign each stock a score, with a ranking that varies from +1 for the best to -1 for the weakest.

Based on the factor analysis powered by AI these stocks are then arranged in an ordered list, with the top-rated stocks at the beginning and the weakest at the end. This list is then divided into Quintiles. By using the quintile definition, we establish five distinct groups of stocks, each comprising 20 different stocks.

However, when using our stock-picking tool, we have the flexibility to adjust the number of stocks in each quintile as needed. In such cases, we employ a technique that allows us to create five groups of ordered stocks, each containing a user-defined number of stocks, denoted as ‘N.’ To accomplish this, we start by dividing our pool of stocks into five groups of 20, adhering to the quintile definition. Subsequently, if we decide to work with a different number of stocks N within each quintile, we select the desired number from the original 20. The method for choosing these N stocks from each quintile is as follows: First, we arrange the stocks within each quintile in ascending order. Then, we take the top N stocks from the top three groups and the bottom N stocks from the bottom two quintiles for further analysis and decision-making

Given that the stocks have been ordered from the strongest to the weakest, this pattern is mirrored in the quintile groups, resulting in Q5 as the group with the highest-rated stocks and Q1 as the group with the lowest-rated stocks.

With our online tool, we can now visualize the performance of each group of stocks. Notably, the top quintiles have demonstrated exceptional performance, transforming a $100,000 investment into over $1 million between 2008 and 2023. Conversely, the lower-rated quintiles exhibited marginal growth.

In this example, we presented how distributing stocks into quintiles can be used for evaluating investment strategies. In conclusion, this concept is highly valuable in formulating a long-short strategy. A long-short strategy involves taking long positions in the quintile that have shown growth potential and short positions in the quintile expected to grow the slowest and it’s useful for risk management, especially in periods of crisis. Employing such a blended approach helps mitigate volatility and minimize drawdown during crisis periods.

Contact us and use Strategies Configurator for building and evaluating your investment strategies.