The AP on the Street 39th week of 2023 – Market Updates

The AP on the Street 39th week of 2023 – Market Updates

Stay informed with our latest financial market updates! Explore insights on indexes, commodities, stock performances, and economic events. Last week, again, we had quite a bad week. This is probably due to government shutdown talks and rising yields, with most of the indexes and commodities we cover being in red, except Russell and Oil being sideways.

This week, we have the ISM Manufacturing PMI and ISM Service PMI, Unemployment Rate, and there will be speeches of Chairman Powell and other FOMC members. So, let’s take a look at what happened last week:

- There were talks related to a government shutdown. However, it was resolved temporarily at the last moment.

- President of Minneapolis FED, Neel Kashkari, said that he is waiting for another rate hike.

- CNN’s The Fear and Greed Index came to the “Extreme Fear” level.

- JP Morgan CEO Jamie Dimon said that the FED funds rate can reach 7%.

- POTUS Biden said UAW should fight for a 40% pay raise.

- Neel Kashkari also added that the FED is not trying to create a recession.

- US10YR yield rose to 4.62%.

- Exxon Mobil shares rose to an all-time high.

- Pfizer shares declined to their lowest level since July 2020.

- US30YR yield rose to 4.75%.

- Euro Zone CPI rose 4.3% year-on-year —20 basis points lower than expected.

- Euro Zone Core CPI rose 4.5% year-on-year —30 basis points lower than expected.

- US Core PCE Price Index rose 3.9% year-on-year, as expected.

- Gold fell down really sharply.

- US Chicago PMI came out as 44.1 points —3.5 points lower than expected.

- Citibank is expecting FED to hike rates in November.

- JP Morgan says the stock valuations are not rational and disconnected from reality, also stating that the SP500 is overvalued.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -1.2%

S&P 500 = -0.8%

NASDAQ = -0.05%

RUSSELL 2000 = +0.2%

Gold = -4.0%

Silver = +5.8%

Oil = +0.6%

The weekly performance of S&P 500 Stocks (market updates)

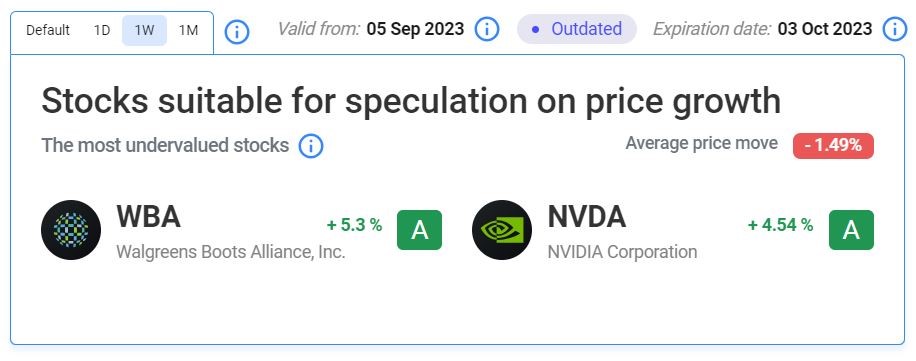

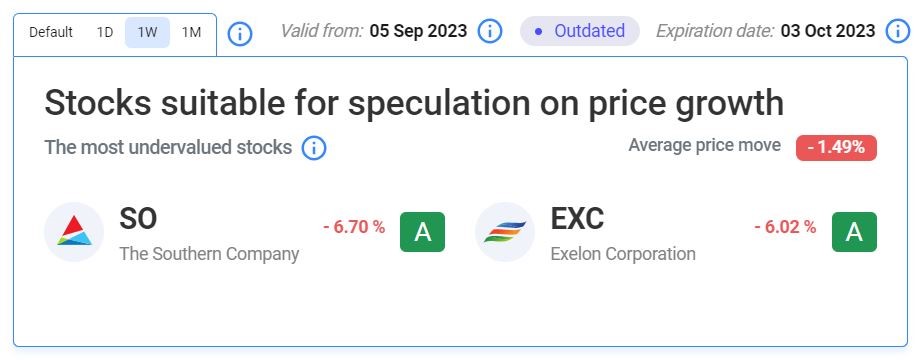

Let’s look at the most undervalued stocks listed on our website:

Our Two Most Performing Stocks:

Our Two Least Performing Stocks:

The main reason(s) for the decline in SO:

Energy company stocks soared recently at the start of the month, and thus, SO probably went down due to that and overall market tendency.

Walgreens stock underperforms amid market turbulence and COVID-19 testing and vaccination demand decline.

The main reason(s) for the decline in EXC:

We deem it’s pretty much the same case with SO.

Important data/ decisions that will be published next week:

The ISM Manufacturing PMI and ISM Service PMI, Unemployment Rate, and there will be speeches of Chairman Powell and other FOMC members.

TIL: What is REPO?

A repurchase agreement (repo) is a form of short-term borrowing where a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day at a slightly higher price. The small difference in price is the implicit overnight interest rate, and repos are typically used to raise short-term capital./span>

For the creation of this newsletter, we are using Summary of Financial Articles software. Are you a financial analyst with the same needs? Try our one-month free subscription.

We will see how the investors will behave after all of the data and decisions. Stay tuned for new market updates.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.