The AP on the Street 38th week of 2023 – Market Updates

The AP on the Street 38th week of 2023 – Market Updates

Stay informed with our latest financial market updates! Explore insights on indexes, commodities, stock performances, and economic events. Last week, we had quite a bad week due to the FED’s pause with an ultra-hawkish stance, with most of the indexes and commodities we cover being in red, except Silver being green and Oil sideways.

This week, we have the PCE and Core PCE Price Index, and the Chicago PMI. So, let’s take a look at what happened last week:

- Tesla is thinking about opening a factory in Saudi Arabia.

- Treasury Secretary Janet Yellen said there are no signs that the US economy is in a downturn and warned against a government shutdown.

- Republican House Speaker McCarthy demanded an 8% government spending cut.

- US National Debt passed $33 trillion.

- US5YR yield rose to 4.5%, the highest level since a year before the Great Recession.

- NVIDIA’s CEO sold another stack of shares. His sell-off totals to almost $110 million.

- US10YR yield rose to 4.5%, the highest level since a year before the Great Recession.

- The US Federal Reserve paused the hiking cycle, thus staying at the 5.5% level, as expected.

- The FED dot-plot 2023 median rate forecast stayed at 5.6%; however, for 2024, the rate forecast rose to 5.10% from the previous 4.6%.

- The FED dot plot shows at least 12 members of the Federal Open Market Committee (FOMC) believe that they will raise the rates by another 25 basis points this year.

- Chairman Powell said the FOMC is prepared to raise rates further if necessary and is strongly committed to bringing inflation to the target level of 2%.

- Mainly NASDAQ, and other indexes sunk after the unexpectedly hawkish FED remarks

- US30YR yield rose to 4.5%, the highest level since 2011.

- JP10YR yield rose to 0.74%, the highest level since 2013.

- The Bank of England paused the hiking cycle, thus staying at the 5.25% level —25 basis points lower than expected.

- The Central Bank of Turkey raised the interest rates by 500 basis points, thus making it 30%, returning to rational policies as expected.

- JP Morgan CEO Jamie Dimon said that the FED may have to raise the rates more to fight against the stickier inflation.

- The US 30-year fixed mortgage rate rose to 7.7%, the highest level since a year before the Dotcom bubble.

- The US stock market wiped almost $1 trillion out in capitalization.

- The Philadelphia FED Manufacturing Index came out as -13.5 points —12.8 points lower than expected.

- US Services PMI came out as 50.2 points —0.4 points lower than expected.

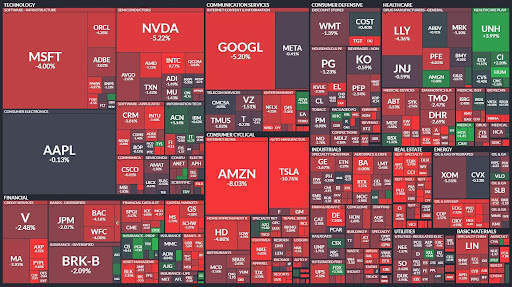

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -1.78%

S&P 500 = -2.8%

NASDAQ = -3.5%

RUSSELL 2000 = -3.4%

Gold = -0.2%

Silver = 1.8%

Oil = 0.1%

The weekly performance of S&P 500 Stocks (market updates)

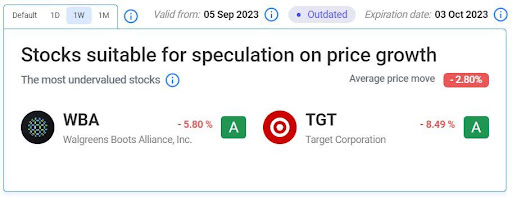

Let’s look at the most undervalued stocks listed on our website:

Our Two Most Performing Stocks:

Our Two Least Performing Stocks:

The main reason(s) for the decline in WBA:

First of all, we had a quite big decline in the broad market, and due to that, there are no other stocks that are green except KHC. So, certainly, there is an influence of the broader market move on these results.

Walgreens stock underperforms amid market turbulence and COVID-19 testing and vaccination demand decline.

The main reason(s) for the decline in TGT:

We could not find a particular reason for TGT to decline that much, certainly it was influenced by the downward trend but we could not find a particular reason for accelerating the decline.

Important data/ decisions that will be published next week:

The PCE and Core PCE Price Index, and the Chicago PMI

TIL: What is Chicago PMI?

The Chicago Purchasing Managers’ Index (Chicago PMI) is a monthly report that measures the health of the manufacturing and non-manufacturing sectors in the Chicago area. It is based on a survey of purchasing managers from various industries who provide their outlook on factors such as new orders, production, employment, supplier deliveries, and inventory levels.

For the creation of this newsletter, we are using Summary of Financial Articles software. Are you a financial analyst with the same needs? Try our one-month free subscription.

We will see how the investors will behave after all of the data and decisions. Stay tuned for new market updates.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.