The AP on the Street 2nd week of 2023

The AP on the Street 2nd week of 2023

The second week of 2023 was quite positive, and the indexes were positive. Powell and other FED members made Hawkish-like comments, but they hinted a pause after a few last hikes.

This week, we have the PPI and Core PPI data. So, let’s take a look at what happened last week:

- Goldman Sachs is planning to cut more than 3000 jobs.

- Bitcoin rose above $20,000.

- Gold jumped to its highest level since April 2022.

- The Dollar index fell to its lowest level since June.

- France’s CAC40 index rose to its highest level since February 2022.

- Germany’s DAX index rose to its highest level since February 2022.

- Euro climbed to its highest level against US Dollar since June 2022.

- Coinbase announced they are about to fire 20% of the workforce.

- JP Morgan CEO Jamie Dimon says the FED may need to increase interest rates to reach above 5%.

- Federal Reserve Chairman Jerome Powell said the FED needs independence to fight inflation. Furthermore, he said he rejects the climate policy mandate by stating that it is not the FED’s business.

- FED’s Michelle Bowman said there is still a lot more work to do concerning inflation.

- Wells Fargo announced it is planning to step back from the mortgage market.

- Bed Bath & Beyond shares jumped more than 200% after getting crushed last week. (Meme-stock rally).

- US CPI Inflation came out to 6.5%, as expected.

- US Core CPI Inflation came out to 5.7%, as expected.

- Janet Yellen, Treasury Secretary, warned that the US would hit the debt ceiling this Thursday.

- Natural Gas tumbled and reached its lowest level since 2021.

Overall Market Indexes & Commodities Moves (Weekly)

DOW = 1.5%

S&P 500 = 2.0%

NASDAQ = 3.7%

RUSSELL 2000 = 4.6%

Gold = 2.3%

Silver = 1.2%

Oil = 7.6%

The weekly performance of S&P 500 Stocks

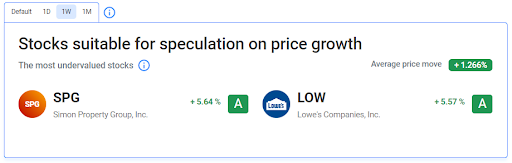

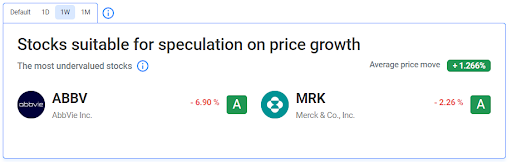

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

The main reason for the decline in AbbVie stock was a decrease in the earnings forecasts.

The main reason for the decline in Merck stock is: they basically completed a tender offer to acquire another company.

TIL: What is the dollar index?

The United States Dollar Index measures the value of the dollar in relation to a basket of foreign currencies, it is a basket of the currencies of the United States’ largest trading partners. When the American dollar gains “strength” compared to other currencies, the Index rises, and vice-versa.

Important data/ decisions that will be published next week:

PPI, Core PPI

The last week was normal for the investors. Next week, Monday will be an off-day for the market due to MLK day. We will see how the investors will behave after the PPI and Core PPI.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.