Distribution of Rebalance Returns – Configuration of Investment Strategies

In this article from our series on “Configuration of Investment Strategies“, we’re introducing a critical performance metric. The Distribution of Rebalance Returns is a useful way to visualize how returns are spread out across different probabilities in an investment strategy. …

The AP on the Street 44th week of 2023 – Trending Factors

The fourth factor-driven weekly newsletter is here. Let’s look at the trending factors from last week (30.10.2023 – 03.11.2023) as detected by our factor investing software. First, we identify the most performing Factors in every Group of Factors (Momentum, Quality, Size, Trend, Volatility). In the …

The AP on the Street 43rd week of 2023 – Trending Factors

The third factor-driven weekly newsletter is here. Let’s look at the trending factors from last week (23.10.2023 – 27.10.2023) as detected by our factor investing software. …

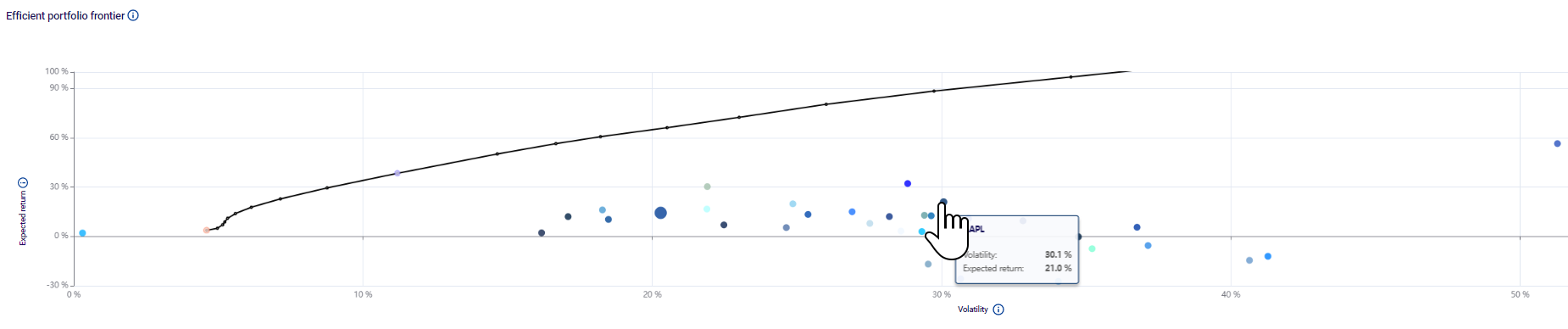

Markowitz’s Modern Portfolio Theory: An Introduction

What is Markowitz’s theory? Markowitz’s theory, commonly known as modern portfolio theory (MPT), is a framework for developing and managing an optimal portfolio of financial assets. It is founded on the premise that investors should examine not only the predicted returns of each asset but …

Return Over Maximum Drawdown (RoMaD) – Configuration of Investment Strategies

In this article from our “Configuration of Investment Strategies” series, we introduce a key performance metric called RoMaD Equity. RoMaD, which stands for “Return over Maximum Drawdown”, provides valuable insights into how well our investment strategies are performing. …