A Comprehensive Analysis of Charles Akre’s Portfolio According to Markowitz’s Modern Portfolio Theory

A Comprehensive Analysis of Charles Akre’s Portfolio According to Markowitz’s Modern Portfolio Theory

Analytical Platform’s analysts took Charles Akre’s portfolio (Akre Capital Management) and analyzed it using Harry Markowitz’s Modern Portfolio Theory, which can be applied through our Portfolio Manager software.

But first of all, who is Charles Akre? Charles T. “Chuck” Akre is an American investor, financier, and businessman. He is the founder, chairman, and chief investment officer of Akre Capital Management, FBR Focus, and other funds. Akre is also on the board of directors of Enstar Group, Ltd. With a long and successful career in the finance industry, Akre is known for his investment philosophy and approach to value investing.

Charles Akre’s investment strategy, which he refers to as the “three-legged stool” approach, involves analyzing a company’s business model, rate of return, and opportunities for reinvestment. The name of the approach is derived from a three-legged milking stool in his office, which represents stability even in uncertain times. In the context of investing, this means that even if the economy experiences turbulence, investors in his fund will be protected from significant losses.

According to Akre, a good investment is a business that has four key attributes:

- Experienced and successful management.

- Solid and sustainable competitive advantages.

- Opportunities for long-term growth and reinvestment.

- A reasonable purchase price relative to the cash flow generated by the company.

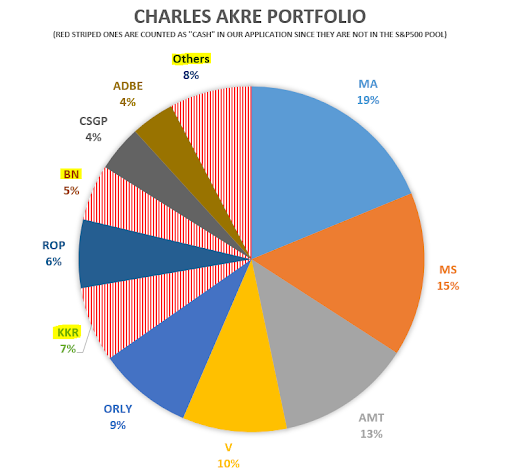

Since we now know who he is and his investment philosophy, let’s look at what he holds in his portfolio. These are (approximately) the publicly-traded U.S. stocks owned by Charles Akre’s holding company Akre Capital, as reported to the Securities and Exchange Commission in filings made available to the public (these figures are taken from GuruFocus website on 09/07/2023):

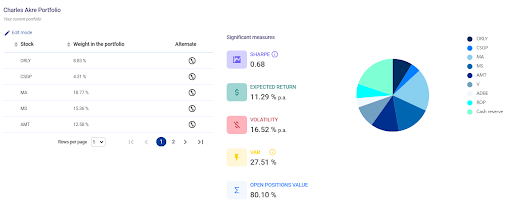

In order to quickly analyze this portfolio, we need to put this portfolio in our Portfolio Manager application. Here is what it looks like there:

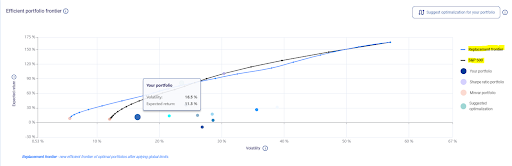

An efficient frontier looks like this:

- The X-axis shows volatility, and the Y-axis shows the expected return, calculated based on price data since 2015.

- The largest blue dot represents the values of Akre’s entire portfolio.

- The second-largest bright green dot represents the values of MPT’s adjusted portfolio.

- The dark-blue efficient frontier consists of stocks from the S&P 500 index.

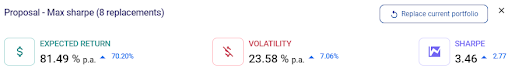

Sharpe Ratio Maximization

- Markowitz’s theory provides the ability to optimize the portfolio by targeting objectives such as minimum volatility, maximum return, or maximum Sharpe ratio. In this example, we aim to refine Chuck Akre’s portfolio to attain the maximum Sharpe value positioned on the curve of efficient portfolios (indicated by the purple dot).

What Is the Sharpe Ratio?

- The Sharpe ratio compares the return of an investment with its risk. It’s a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk rather than investing skill.

The maximum Sharpe ratio portfolio

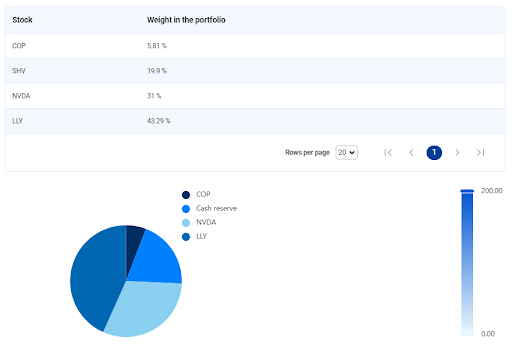

- The maximum Sharpe ratio portfolio would contain only four stocks, with weights ranging from 5.81% to 43.29%. And the cash reserve rate is the same as our initial portfolio, 19.90%.

By implementing Markowitz’s Modern Portfolio Theory, one can potentially boost the expected annual return from 11.29% to 81.49%, increase the annual volatility from 16.52% to 23.58%, and enhance the Sharpe ratio from 0.68 to 3.46 as part of the portfolio adjustment process.

Which approach is better? Chuck Akre’s or Markowitz’s?

We would be happy to analyze your own portfolio as well. For this purpose, we suggest using the Portfolio Manager application or other Analytical Platform tools.

Are you curious about the performance of your investment portfolio?

Wondering if there’s room for improvement? Look no further! The Portfolio Manager App is here to help, offering personalized analysis based on the same principles used to evaluate Charles Akre’s renowned Akre Capital Management portfolio.

By utilizing the Portfolio Manager App, you can gain insights into your investments, just as we did with ACM’s portfolio. Discover how to optimize your holdings according to objectives such as minimum volatility, maximum return, or maximum Sharpe ratio, empowering you to make more informed decisions about your investments.

Book Your Portfolio Optimization Meeting with Analytical Platform Now!

Here’s what you can expect from the Portfolio Manager (PM) App. It will:

- Evaluate your portfolio’s performance based on price data.

- Assess the volatility and expected return of your investments.

- Identify the optimal mix of stocks for your desired level of risk and return.

- Strategically allocate assets to potentially increase your portfolio’s Sharpe ratio.

Don’t miss out on this opportunity to elevate your investment strategy. Try it today and see the difference a well-informed approach can make!