What Software is Used in Modern Portfolio Theory?

What Software is Used in Modern Portfolio Theory?

How to do Modern Portfolio Theory? Finally, there is a web application software called Portfolio Manager developed directly for leveraging Harry Markowitz’s Modern Portfolio Theory.

A few months ago the answer would have been „none“. Of course, there is an option to try to apply this Nobel-awarded theory with the help of Excel or MATLAB. However, Excel is not as powerful and fast as needed for this approach, and using MATLAB requires advanced programming skills. Both options are also connected with the absolute necessity for imputing correct and up-to-date data about analyzed assets.

One of our B2B clients, a securities trader broker was trying to apply Markowitz’s theory by Excel, facing the mentioned issues but also making mistakes on a theoretical level. A strong statistical background is needed for the automation of the MPT.

That is why we were approached to develop software that leverages MPT theory into practice. You can see for yourself how it turned out.

Information about portfolio

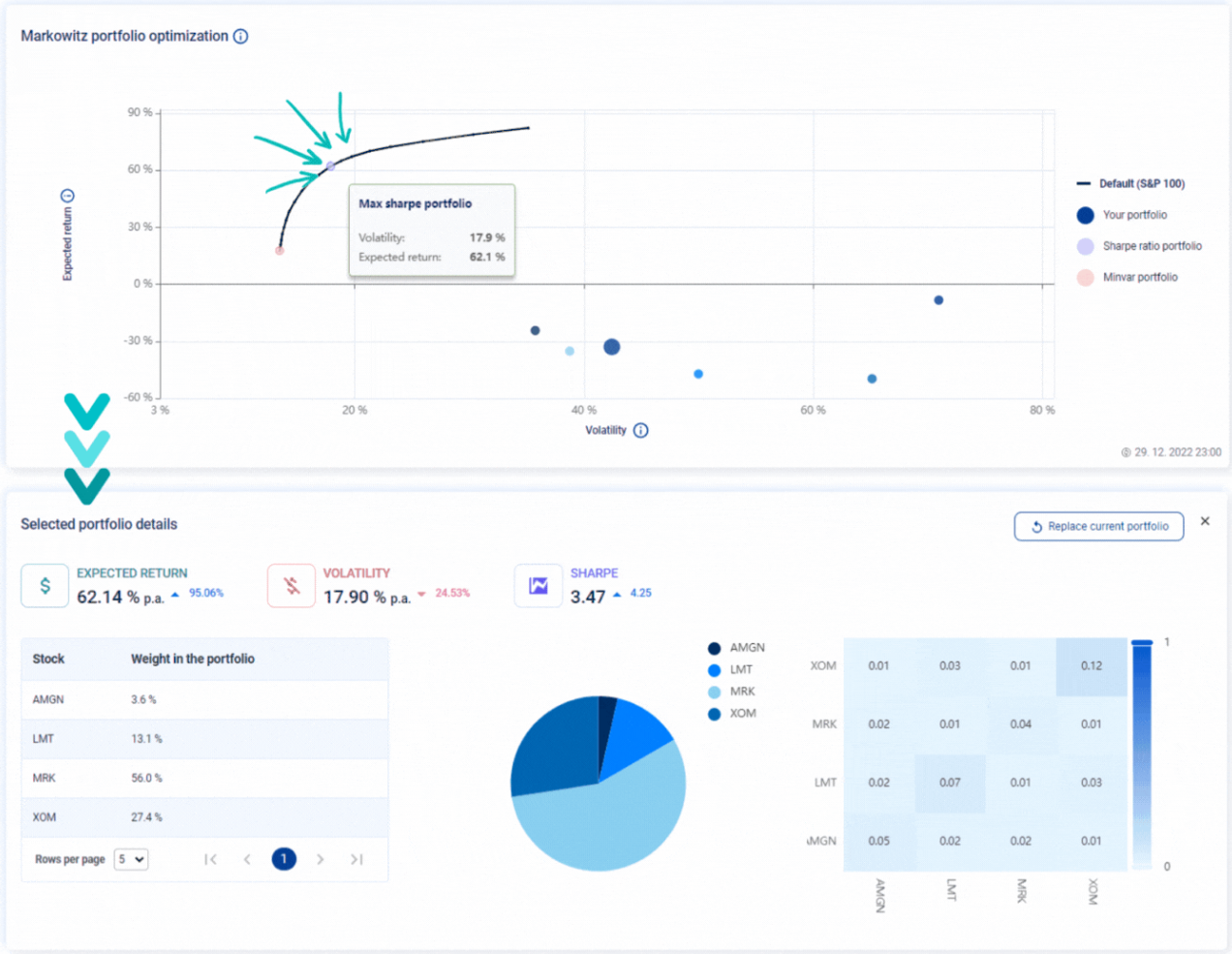

Based on Markowitz’s Modern Portfolio Theory, the software provides calculations of Expected return, Volatility, Sharpe ratio, and Value at risk of the imported portfolio. The portfolio is shown in the chart and compared with the effective frontier. There is also a portfolio metrics history showcase.

Portfolio optimization

The application provides you with many personified features such as selecting the weight for stocks in the portfolio, choosing the time frame, substitution of unwanted shares, and much more.

Learn more about all the features we implemented or directly try out the Portfolio Manager Application. You can also see our two use cases analyzing Warren Buffet’s portfolio and Charles Akre’s portfolio with the help of Portfolio Manager software.