Maximum Drawdown

Maximum Drawdown

The article from the series “Configuration of Investment Strategies” presents the Maximum Drawdown Percentage that we use in the StockPicker configurator.

Maximum Drawdown Tables offer a concise snapshot of an investment’s performance and risk through three key metrics:

- Maximum Drawdown Percentage: Shows the largest percentage decline from the investment’s peak, indicating potential risk.

- Monetary Impact of Drawdown (USD column): Quantifies the actual monetary decline during the investment period, providing a tangible measure of financial impact.

- Longest Drawdown Period: Reveals the duration an investment remained below its peak value, aiding in understanding recovery timelines. These tables help investors assess risk, evaluate performance, and make informed decisions.

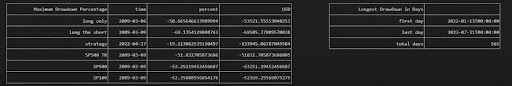

In this screenshot, we can assess how our various strategies and our benchmark performed in the worst-case scenario, specifically their ability to maintain low volatility during financial turmoil. We will examine:

- a) The date when the Maximum Drawdown occurred

- b) The severity of the drawdown in percentage terms

- c) The severity of the drawdown in absolute numbers (USD)

The first three rows of the table present the performance of the three AI strategies under analysis.

- The “Long-only” approach selects its stocks from our pool of stocks that replicate the SP100. However, instead of holding the entire portfolio, it concentrates on acquiring the highest-performing stocks, with a monthly rebalancing strategy. These are the stocks expected to perform the best. You have the flexibility to determine the size of your portfolio, i.e., the number of stocks to include

- The “Long the Short” statistic is a measure we employ to assess the AI’s ability to predict stocks perform the worst. In this scenario, we are taking long positions on stocks expected to perform poorly,

but we are not actually purchasing them. This statistic serves as a tool to evaluate whether the AI can effectively distinguish between winning and losing stocks. If this distinction holds true, we should observe “Long the Short” displaying poorer overall performance compared to “Long Only” and “Strategy.”

The “Strategy” maintains long positions in the top-performing stocks (The ones in “Long-only”) while simultaneously shorting the poorest-performing ones (The ones in “Long the short”). Similar to the previous strategy, you can customize the number of stocks in your portfolio. Additionally, you have the freedom to balance how you allocate your capital. In our example, we allocated 60% of the capital to long positions and 40% to short positions, with a chosen leverage of 1.5x.

These parameters are also adjustable to meet your preferences. For an explanation see the article “Equities of Strategy and Benchmarks”

The next 3 rows in the table “SP500 TR” “SP500” and “SP100” are our benchmarks.

- SP500 TR is the SP500 Total Return, that is the behavior of the Sp500 considering the reinvestments of the dividends

- SP500 is the Sp500 index

- Sp100 is the Sp100 index

Now, thanks to the table, we can evaluate how our strategies performed compared to the benchmarks. First, let’s examine the performance of the “Long Only Strategy.” The maximum drawdown observed was -50% during the 2008/2009 crisis. This level of volatility is expected for this strategy, as it is our most aggressive one. High volatility is anticipated and is typically rewarded with higher returns. Nevertheless, the drawdown of this strategy was still slightly lower than that of the market, where the maximum drawdown for the S&P 100 was -52%.

Moving on to the “Long the Short Strategy,” as expected, we can see that our model performed well. As discussed previously, this strategy tests our model’s ability to identify underperforming stocks. The maximum drawdown for this strategy was -69%. This was notably worse than the S&P 100.

In the third row, we observe the Drawdown performance of our “Strategy.” This strategy maintains long positions in the top-performing stocks (those in “Long Only”) while simultaneously shorting the poorest-performing ones (those in “Long the Short”). Consequently, it maintains low volatility even during crises. For instance, during the 2008 crisis, our strategy had a maximum drawdown of only -19%. In the smaller table below, you can see the time it took for our “Strategy” to recover from its drawdown, which was 565 days.