Strategies Drawdown

Strategies Drawdown

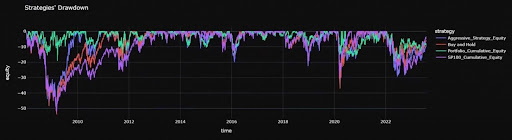

The article from the series “Configuration of Investment Strategies” presents the Strategies Drawdown plot that we use in the StockPicker configurator.

The drawdown plot serves as a valuable tool for analyzing how much an investment declines from its peak before it recovers. Visualizing maximum drawdown aids in evaluating potential risks and losses, facilitating a deeper understanding of historical performance. It plays a crucial role in managing expectations, constructing diversified portfolios, and preparing for both short-term setbacks and long-term recovery, thereby ensuring investments align with goals and risk tolerance.

Through this visualization, we gain insights into:

Two benchmark indicators:

- “Buy and Hold” shows how a portfolio composed of the stocks we have in our stock basket to date has performed (*95% tracks the current S&P 100 index). These are stocks for which we have long-term data. Compared to the benchmark, in the basket, there is included, for example, the OXY share. Conversely, TSLA is missing.

- The second benchmark is the “SP100 Cumulative Equity”, which illustrates the value of the S&P 100 index over time.

Our two distinct strategies:

- The “Aggressive Strategy Equity” approach selects its stocks from the “Buy and Hold” benchmark. However, instead of holding the entire portfolio, it concentrates on acquiring the highest-performing stocks, with a monthly rebalancing strategy. These are the stocks expected to deliver the strongest performance each month. You have the flexibility to determine the size of your portfolio, i.e., the number of stocks to include, in the example plot, we utilized 20 stocks.

- The “Portfolio Cumulative Equity” strategy also derives its stock picks from the “Buy and Hold” pool. In this case, it maintains long positions in the top-performing stocks while simultaneously shorting the poorest-performing ones. Similar to the previous strategy, you can customize the number of stocks in your portfolio. Additionally, you have the freedom to balance how you allocate your capital. In our example, we allocated 60% of the capital to long positions and 40% to short positions, with a chosen leverage of 1.5x.

These parameters are also adjustable to meet your preferences. For an explanation see the article “Equities of Strategy and Benchmarks”

Thanks to the plot we can evaluate the drawdown performance of the strategies. As anticipated, we observe that the two benchmarks experienced similar maximum drawdowns, with notable downward spikes of -52% during the 2008/2009 financial crisis.

Upon analyzing the portfolios, we note that the “Aggressive strategy Equity” displays high volatility, resulting in a drawdown profile similar to that of the market. This is expected since this strategy is created for risk-tolerant investors who can handle a lot of short-term volatility and will consequentially be rewarded with very high returns. However, the strategy that we want to draw your attention to is the “Portfolio Cumulative Equity“. As previously explained, this represents the loss-averse approach. To achieve robust returns with low volatility, the AI employs a dual strategy of longing for winning stocks that will make us make money during bull markets and shorting losing stocks to hedge losses in order to reduce the volatility during crises and bear markets.

This strategy’s effectiveness shines through in this analysis. What was a significant drawdown for the market translated into a minor inconvenience for the strategy. During the 2008/2009 crises, the max drawdown decreased from a substantial -52% to just -19%. This not only demonstrates lower volatility during crises but also showcases minimal drawdowns throughout various market turbulences.