Introduction to the Model Training

Introduction to the Model Training

In the coming weeks, the first test users are going to be allowed to use the Beta version of the StockPicking Lab application in version 2.0, which significantly expands the possibilities of building robust investment strategies. Introduction to our model training.

Let’s first recall what the current version of StockPicking Lab can do:

- Stock Ranking

Once a month, a new prediction is calculated. It ranks the stocks from the S&P100 index from the relatively most undervalued to the most overvalued. Based on big data/long time frame, undervalued stocks grow faster than overvalued stocks.

As for the S&P100 index, it is not an exact match, specifically, we are currently evaluating 99 stocks for which we have quality historical data available. For instance, our share pool includes OXY, but TSLA, on the other hand, is missing.

Predictions are based on a linear model that has been running since June 2020. During that time, it has outperformed backtested estimates.

- Investment strategies

Investment strategies can then be built on the Stock Ranking. For this purpose, we have created a configurator that allows you to find out what is the optimal exposure of Long/Short positions, the leverage, the number of shares in individual positions, and much more. We are going to introduce the configurator in more detail in one of the following articles.

In the current version of StockPicking Lab, there are two strategies to choose from:

- Hedged, which applies a leverage of 1.5, holds 60% of the most undervalued stocks, and by 40% speculates on the decline of the most overvalued stocks.

- Aggressive, which holds only the most undervalued stocks in the portfolio.

The current version is suitable for users who choose to copy the mentioned strategies on their investment accounts, or modify them slightly – the application allows, for example, the replacement of shares for which users do not trust the prediction.

Analysts and portfolio managers in investment companies usually rely more on their judgment. In future versions, we, therefore, open up the application and allow users to build and test their own models. So what features can we look forward to?

1) Training of own models

2) Strategies Backtester

3) Using of own stock pools (for example, SP500; FAANG; 10 stocks we currently believe in the most;…)

4) Detailed decomposition of scores and determination of the significance of individual factors for specific stocks (more information in the New Era of Stockpicking articles).

5) Real-time monitoring of strategy behavior in connection with the configurator and back tester.

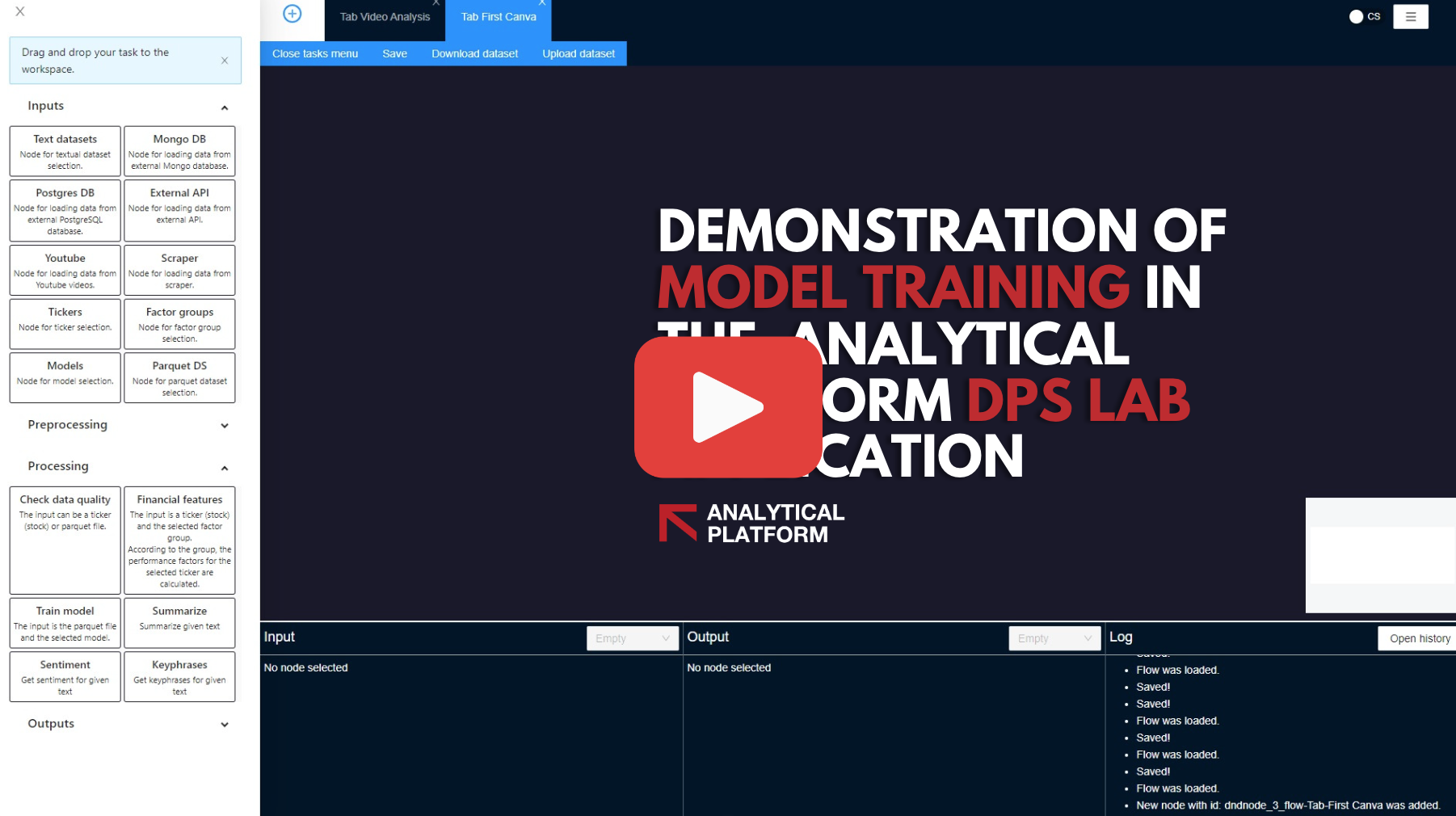

In today’s article, we will show an example of how to train investment models. We will use our DPS Lab application, the APPL ticker, the fin_stat_moments group of statistical factors, and the ridge model for a simplified demonstration.

The model training procedure is available in the video Demonstration of model training in the Analytical Platform DPS Lab Application.

As an output of model training, we get the Score value, which tells us how much percent of deterministic movement (i.e. non-random) the model explains, as well as the Coef/beta coefficient values, which weigh the value of the factors and thereby directly co-create the prediction.

Once the updated version of StockPicking Lab is released, we will show the complete model training process on broad stock pools and individual user preferences.

For more information and priority access to the Beta version of the upgraded StockPicking Lab application, do not hesitate to contact us.