The AP on the Street 30th week of 2023

The AP on the Street 30th week of 2023

Last week, again, we saw a pretty neutral environment, with some indexes & commodities green and some not. Also, we had quite a busy earning week. This week we have the ISM Manufacturing PMI and the Unemployment Rate. So, let’s take a look at what happened last week:

-

- Twitter is now completely rebranded. Changed its logo and name to “X”

- “Barbenheimer” passed the $235 million mark in the domestic market.

- General Motors beat its earnings and revenue estimates.

- 3M beat its earnings and revenue estimates.

- General Electric beat its earnings and revenue estimates.

- Snapchat shares sunk after awful Q3 forecasts.

- Various investment banks warned investors of a potential Bank of Japan pivot, saying the CB might stop buying bonds to lower yields.

- Boeing beat its earnings and revenue estimates.

- Banc of California agreed to acquire Pacific Western Bank.

- Microsoft drops after slowing cloud growth and AI spending.

- Alphabet stock jumped after Q2 results.

- Federal Reserve raised the interest rates by 25 basis points, as expected —making it 5.50%, the highest level since January 2001.

- FED is considering additional tightening to curb inflation.

- Chairman Powell said that the process of getting inflation to 2% has a long way to go, and the FOMC will take a more data-dependent approach to future hikes.

- Chairman Powell also said that the policy is not restrictive sufficiently for long enough. He also said that there is a possibility of a hike or pause in September, depending on the data.

- Chairman Powell also said that they are prepared to tighten the conditions further.

- Mcdonald’s beat its earnings and revenue estimates.

- European Central Bank raised the interest rates by 25 basis points, as expected —making it 4.25%.

- US GDP in 2023Q2 rose 2.4% quarter-on-quarter —60 basis points higher than expected.

- Bud Light is laying off hundreds of employees after a sales slump.

- Exxonmobil beat its revenue estimates but did not beat earnings expectations.

- Chevron beat its earnings and revenue estimates.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.8%

S&P 500 = 0.3%

NASDAQ = 2.1%

RUSSELL 2000 = 1:0%

Gold = -0.1%

Silver = -1.0%

Oil = 4.8%

The weekly performance of S&P 500 Stocks

Earnings Section:

Next week and this week, from our long top 20 stocks, we will have earnings for the following tickers:

1. PFE (August 1st)

2. SBUX (August 1st)

3. DD (August 2nd)

4. CVS (August 2nd)

5. QCOM (August 2nd)

6. BKNG (August 2nd)

7. DUK (August 3rd)

8. DIS (August 8th)

9. ORCL (September 11th)

PFE: Pfizer Inc. is a research-based global biopharmaceutical company that engages in the discovery, development, manufacture, marketing, sales, and distribution of biopharmaceutical products worldwide. Its business spans the following therapeutic areas: vaccines, oncology, internal medicine, hospital, inflammation and immunology, and rare disease.

It currently stands at 18th place in our top 20 long stocks due to its good amount of points from the PTBV indicator. Compares the company’s market capitalization to all of its tangible assets.

Last quarter it managed to beat its EPS estimates of 0.98 estimated and 1.23 actual. This quarter analysts increased the estimation for the EPS by estimating a 0.52 EPS (a 57% decrease compared to the last actual figure).

After the earnings announcement, we will see how it will affect our decomposed score.

SBUX: Starbucks Corporation is an American multinational chain of coffeehouses and roastery reserves. It is the leading roaster, retailer, and marketer of specialty coffee in the world. Starbucks is headquartered in Seattle, Washington, and is seen to be the major representation of the United States’ second wave of coffee culture.

It currently stands in 4th place in our top 20 long stocks due to its good amount of points from the CCI 4 indicator. Compares the present and historical price data to determine whether an asset is overbought or oversold

Last quarter it managed to beat its EPS estimates of 0.65 estimated and 0.74 actual. This quarter analysts increased the estimation for the EPS by estimating a 0.86 EPS (a 16% hike compared to the last actual figure).

We will see how it will affect our decomposed score after the earnings announcement

Important data/ decisions that will be published next week:

The FOMC Interest Rate decision, Q2 GDP, Services PMI, and the PCE and Core PCE prices

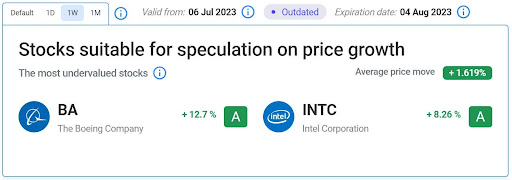

Let’s look at the most undervalued stocks listed on our website:

Our Top Two Performing Stocks:

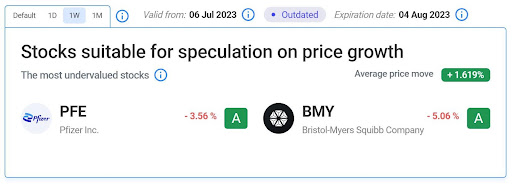

Our Two Least Performing Stocks:

The main reason(s) for the decline in PFE:

PFE suffered this week due to the stock’s poor EPS estimate on this week’s earnings call.

The main reason(s) for the decline in BMY:

BMY did not beat its earnings and revenue expectations.

TIL: What is EPS?

EPS stands for Earnings Per Share. It is a financial metric used to measure a company’s profitability by dividing its net income by the total number of outstanding shares of its common stock. EPS is an important indicator of a company’s financial health and is often used by investors to evaluate the company’s performance and to compare it with other companies in the same industry. A higher EPS generally indicates that a company is generating more profits and is, therefore, more attractive to investors.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.