The AP on the Street 22nd week of 2023

The AP on the Street 22nd week of 2023

Last week, investors enjoyed an excellent rally; most indexes and commodities enjoyed great returns, especially Russell 2000 and NASDAQ.

We have quite a boring week this week. We have only ISM Non-Manufacturing PMI, and Services PMI. So, let’s take a look at what happened last week:

- Congress passed the US debt ceiling deal, and POTUS Biden signed it —averting the government default drama.

- The Turkish Lira hit a record low after the official results.

- US Stock Markets were closed on Monday due to Memorial Day.

- NVIDIA shares hit another record high.

- NVIDIA hit a $1 trillion market capitalization.

- Apple stock rose to a 52-week high, the highest level since Jan 2022.

- Member of the FED Board of Governors Philip Jefferson said that a rate pause at the upcoming meeting does not mean rates are at peak. He also said skipping the rate hike would give the FED more time to assess data accurately.

- Elon Musk, again, retook the title of “the world’s richest person.”

- Target shares plunged after the boycott concerns.

- Euro Zone CPI rose 6.1% year on year —90 basis points lower than expected.

- Euro Zone Core CPI rose 5.3% year on year —20 basis points lower than expected.

- Odds of a potential hike pause jumped after the officials implied a skipping period.

- ISM Manufacturing PMI came out as 46.9 points —0.1 points lower than expected.

- US Unemployment rate rose to 3.7%, 30 basis points more than its previous level —20 basis points more than expected.

- Chicago PMI came out as 40.4 points —6.6 points lower than expected.

- JOLTs came out as 10.103 million —0.328 million higher than expected.

- Jerome Powell will testify at the US Senate on June 22nd.

- OPEC+ is planning to cut the outputs. Saudis will do a voluntary production cut of 1 million barrels a day.

• Recently appointed market darling Turkish Finance Minister, Mehmet Simsek, announced that Turkey will return to orthodox economic theories —publicly dumping Erdogan’s heterodox policy suggestions.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 2.0%

S&P 500 = 1.8%

NASDAQ = 2.0%

RUSSELL 2000 = 3.2%

Gold = -0.03%

Silver = 1.0%

Oil = -1.3%

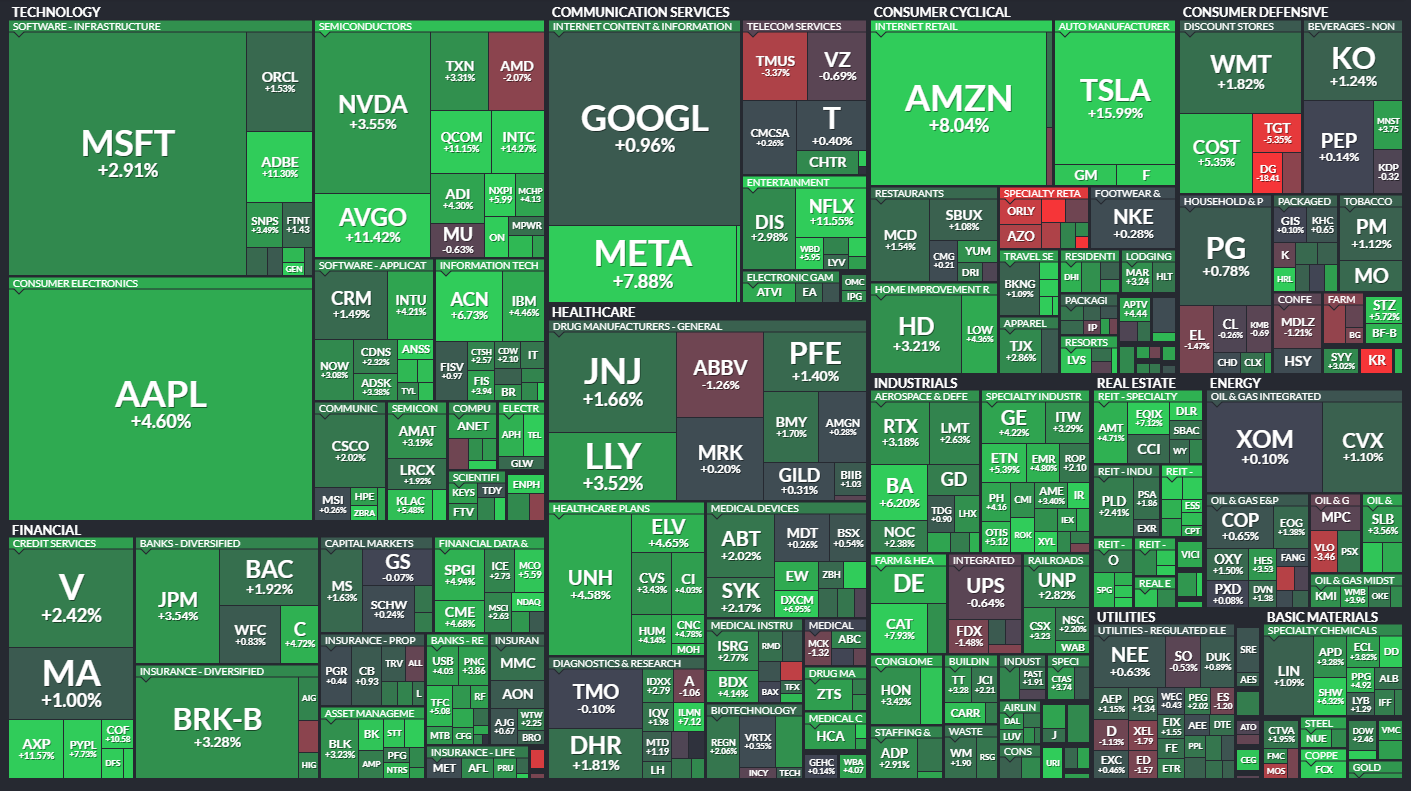

The weekly performance of S&P 500 Stocks

Important data/ decisions that will be published next week:

ISM Non-Manufacturing PMI, Services PMI

TIL: What is OPEC+?

OPEC+ refers to the alliance of crude producers who have been undertaking corrections in supply in the oil markets since 2017. At the core of this group are the 13 members of OPEC (the Organization of the Oil Exporting Countries), which are mainly Middle Eastern and African countries. OPEC+ represents around 40% of world oil production, and its main objective is to regulate the supply of oil to the world market.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.