The AP on the Street 21st week of 2023

The AP on the Street 21st week of 2023

Last week, we had an uncertain week. DOW plunged, and NASDAQ jumped; other indexes were mostly sideways while commodities went down except Oil.

We have Chicago PMI, JOLTs, ISM Manufacturing PMI, and the Unemployment Rate. So, let’s take a look at what happened last week:

- White House says a potential government default would lead to a catastrophic stock market decline.

- Meta was fined by the EU for data transfers to the US.

- St. Louis Federal Reserve President James Bullard said that they would have to move the rates higher to tame inflation.

- Bullard also said that he is anticipating two more rates, 50 basis points, this year.

- Bullard additionally stated that US recession probabilities are overstated.

- Minneapolis Federal Reserve Bank President Neel Kashkari said that the rates could go above 6%, but it is unclear.

- Kashkari also said that the FED has to keep fighting against inflation.

- Erdogan won the second round of the elections in Turkey.

- Germany’s Manufacturing PMI came out as 42.9 —2.1 points lower than expected.

- Euro Zone Manufacturing PMI came out as 44.6 —1.6 points lower than expected.

- US Manufacturing PMI came out as 48.5 —1.5 points lower than expected.

- US Services PMI came out as 55.1 —2.5 points higher than expected.

- The Reserve Bank of New Zealand increased the interest rates by 25 basis points, as expected —making it 5.50%.

- UK CPI rose 8.7% year on year —50 basis points higher than expected.

- UK Core CPI rose 6.8% year on year —60 basis points higher than expected.

- Meta started the final round of layoffs.

- The yields on some T-Bills surge past 7% amid the ceiling drama.

- Florida Governor Ron DeSantis announced that he is running for the 2024 presidential elections.

- NVIDIA shares soared after better-than-expected earnings.

- Germany’s GDP declined 0.3% quarter on quarter —officially entering a recession.

- US Core PCE prices rose 4.7% year on year —10 basis points higher than expected.

- Biden and McCarthy agreed on a debt ceiling raise deal, adding $4 trillion to the limit.

- US PCE prices rose 4.4% year on year —50 basis points higher than expected.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = -2.4%

S&P 500 = 0.3%

NASDAQ = 2.5%

RUSSELL 2000 = -0.5%

Gold = -1.7%

Silver = -2.4%

Oil = 0.7%

The weekly performance of S&P 500 Stocks

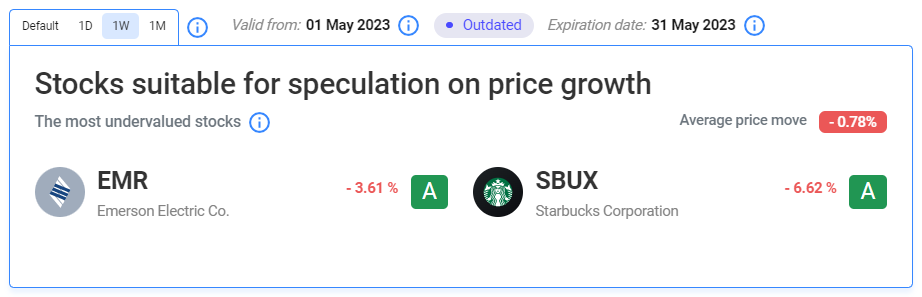

Let’s look at the most undervalued stocks listed on our website:

The main reason(s) for the decline in EMR:

We could not find a specific reason for the EMR stock to decline.

The main reason(s) for the decline in SBUX:

We could not find a specific reason for the SBUX stock to decline.

Important data/ decisions that will be published next week:

Chicago PMI, JOLTs, ISM Manufacturing PMI, and the Unemployment Rate

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.