The AP on the Street 11th week of 2023

The AP on the Street 11th week of 2023

We had a rough week concerning the macroeconomic environment, but the markets were up due to the interest rate pause anticipation.

This week is really crucial, and we have the FED interest rate decision, Services PMI, and Manufacturing PMI. So, let’s take a look at what happened last week:

- Signature Bank was closed on Sunday by the State regulators.

- Federal Reserve said that they are ready to address any potential liquidity pressures.

- The US Dollar Index went down due to the rate hike pause bets.

- Goldman Sachs no longer expects the FED to hike in March due to the troubles in the banking system.

- US Treasury officials said the situation is unlike 2008, and the depositor protection should not be considered as a bailout.

- The yield curve lost its inversion after the FED pause anticipations.

- HSBC acquired the SVB’s UK branch, protecting the depositors.

- European stocks collapsed due to bank sell-offs.

- UniCredit shares halted in Milan.

- Credit Suisse shares saw an all-time low.

- Regional bank shares in the US plunged.

- Coinbase was holding $240 million in cash at Signature Bank.

- POTUS Biden said those responsible for the SVB’s collapse would be held accountable.

- Euro Zone money markets now predict a 25 bps rate hike instead of 50.

- Credit Suisse credit default swaps hit a record high.

- NY FED now expects one-year inflation to become 4.2% instead of 5%.

- US yields plunged after investors’ anticipation of a rate hike pause.

- US CPI rose 6.0% year-on-year, as expected.

- US Core CPI rose 5.5% year-on-year, as expected.

- Meta will lay off 10,000 employees and close 5,000 open roles.

- Crude Oil went below $70 a barrel for the first time since December 2021.

- US PPI rose 4.6% year on year —80 basis points lower than expected.

- US Core PPI rose 4.4% year on year —80 basis points lower than expected.

- NY FED Empire State Manufacturing index plummets to -24.6 points —16.6 points worse than expected.

- Credit Suisse CEO said that the bank’s liquidity base is strong.

- Germany 10YR saw its most significant one-day drop since 1990.

- According to Reuters, the Swiss government faced pressure from at least one major government to intervene in Credit Suisse.

- Swiss National Bank said it would provide Credit Suisse with liquidity if necessary.

- Credit Suisse borrowed around $50 billion from SNB.

- The US demanded TikTok owners sell a stake in the company or face a ban in the US.

- Credit Suisse shares jumped after the bailout.

- ECB hiked the interest rate by 50 basis points, making it 3.5%.

- A total of 11 banks announced that they would deposit $30 billion to First Republic Bank.

- Bitcoin soared above $28,000.

- Federal Reserve expanded its balance sheet by nearly $300 billion last week, the largest since 2020 —thus, temporarily ending the quantitative tightening.

- Silicon Valley Bank filed for Chapter 11 bankruptcy.

- First Republic Bank shares plummeted despite the $30 billion rescue plan due to increasing fears.

- Bank of America shares fell to their lowest level since December 2020.

- Switzerland was considering nationalizing Credit Suisse fully or partly.

- UBS agreed to buy Credit Suisse for 3 billion CHF, and SNB offered $100 billion in liquidity as a part of the deal.

- UBS credit default swaps jumped around 50 basis points after the deal.

Overall Market Indexes & Commodities Moves (Weekly) (By taking the opening price on Monday and closing price on Friday, using MSN Money)

DOW = 0.4%

S&P 500 = 2.5%

NASDAQ = 5.1%

RUSSELL 2000 = 0.1%

Gold = 3.5%

Silver = 4.5%

Oil = -11.1%

The weekly performance of S&P 500 Stocks

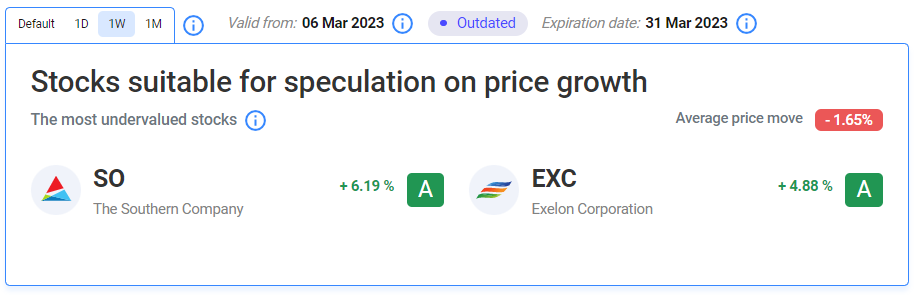

Let’s look at the most undervalued stocks listed on our website:

Our Two Least Performing Stocks:

Again, as explained in the last week, the reason for both MET and AIG stock’s decline was the global banking sector distress since they both are insurance companies.

More news:

- As a part of the deal, the Swiss government guaranteed 9 billion CHF on CS losses.

- SNB President said a potential bankruptcy of Credit Suisse would have had severe global consequences.

- The Swiss President said restoring confidence in Credit Suisse was impossible and added that the UBS deal was the best solution to end the crisis.

- UBS plans to cut CS’s investment bank branch after the deal and will name Ralph Hamers as the CEO of the combined bank.

- Swiss Finance Minister said that the government regrets Credit Suisse could not solve the crisis itself, adding that this is not a bailout but a commercial solution.

- Federal Reserve, European Central Bank, Swiss National Bank, Bank of England, Bank of Japan, and Bank of Canada announced a coordinated central bank action to improve liquidity by swap lines.

- Powell and Yellen said the US banking system is robust and resilient in a joint statement.

TIL: What is a leveraged buyout?

A leveraged buyout (LBO) is when a company is acquired using a significant amount of borrowed money (bonds or loans) to meet the acquisition cost. The company’s assets being acquired are often used as collateral for the loans.

Important data/ decisions that will be published next week:

The FED interest rate decision, Services PMI, and Manufacturing PMI

The last week was a completely different level. Distressed banks, rate pause anticipations, etc… One can draw parallels between those events and the Great Recession; however, we believe that despite all the horrible things happening, it is still early to talk about a global financial crisis.

We will see how the investors will behave after all of the data and decisions. Stay tuned.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.