The AP on the Street 3rd week of 2023

The AP on the Street 3rd week of 2023

The last week was insane. The market had a negative week; however, concerning the news, the week started with Janet Yellen’s government bankruptcy warning and President Biden’s bombshell “no compromise on debt ceiling” comment.

This week is also quite significant. We have the PCE inflation, Q4 GDP Growth, and Services PMI data. So, let’s take a look at what happened last week:

- White House said they would not negotiate and compromise over the debt ceiling.

- Janet Yellen warned the US about the default risk by June and insisted on a debt limit hike.

- Markets were closed on Monday due to MLK day

- Natural gas jumped 10% during freezing winter conditions in the US.

- Goldman Sachs missed earnings estimates in Q4 due to diminishing Investment Banking and Asset Management revenues.

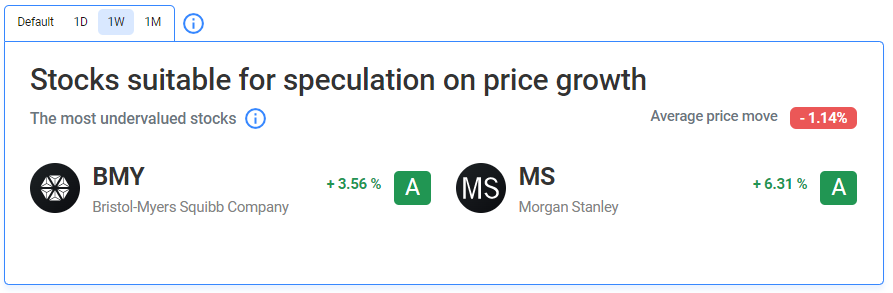

- Morgan Stanley beat Q4 earnings expectations. MS stock soared.

- US January New York Empire State Manufacturing Index tumbled to -32.9 points —24.2 points lower than expected.

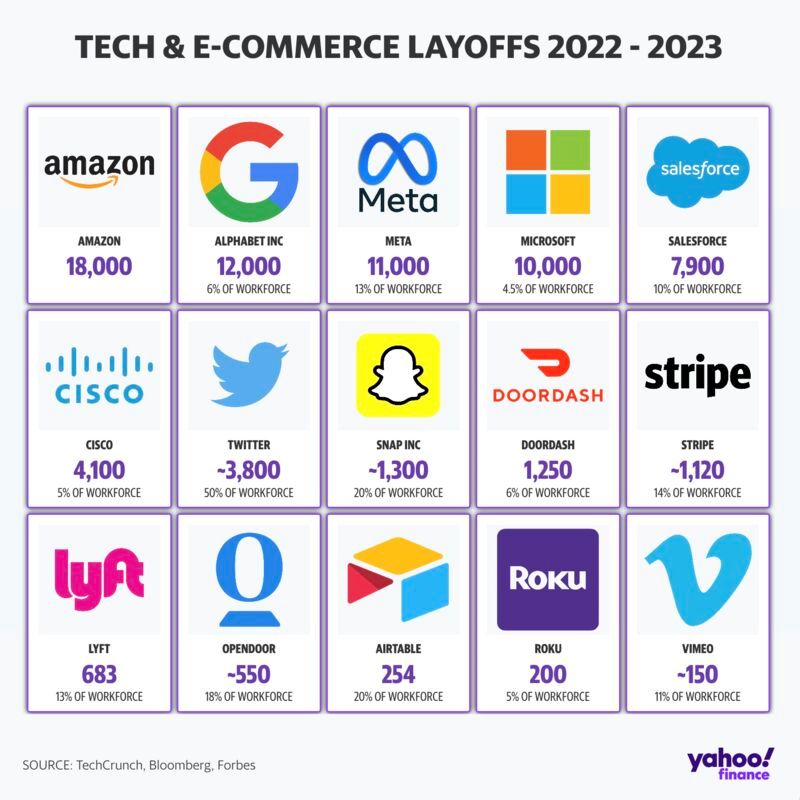

- Microsoft announced they plan a 10,000 job cut amid the Tech Layoff —nearly 5% of its workforce.

- UK’s CPI rose 10.5% year on year, as anticipated.

- UK’s core CPI rose 6.3% year on year —10 basis points higher than expected.

- US PPI rose 6.2% year on year —60 basis points better than expected.

- US core PPI rose 5.5% year on year —20 basis points better than expected.

- US core retail sales declined 1.1% month on month —70 basis points worse than expected. The most significant monthly drop since December 2021.

- Jerome Powell caught COVID, showing weak symptoms.

- US stocks fell after the sales data showed a cooling down economy.

- The US10YR yield dropped to its lowest level since September.

- European stocks plunged after global recession fears.

- Various FED policymakers called for further rate hikes to cool down rampant inflation.

- JP Morgan CEO Jamie Dimon said the rates need to rise above 5% due to “a bunch of underlying inflation.”

- US January Philadelphia Manufacturing Index rose to -8.9 points —2.1 points better than expected.

- Alphabet (Google’s parent company) is now planning to cut 12,000 jobs amid the Tech Layoff.

Overall Market Indexes & Commodities Moves (Weekly)

DOW = -2.5%

S&P 500 = -0.8%

NASDAQ = 0.7%

RUSSELL 2000 = -0.9%

Gold = 0.6%

Silver = -0.6%

Oil = 1.0%

The weekly performance of S&P 500 Stocks

Let’s look at the most undervalued stocks listed on our website:

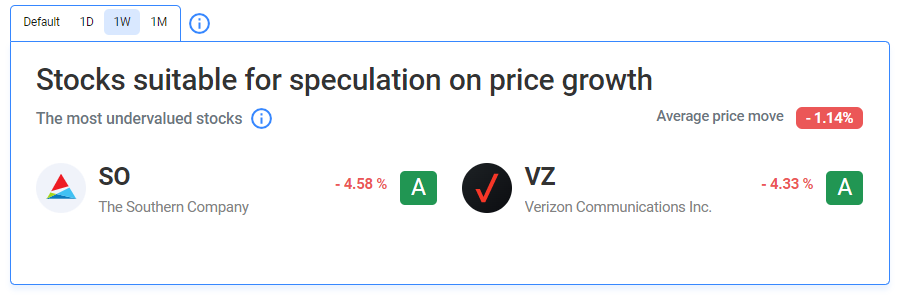

Our Two Least Performing Stocks:

The main reason for the decline in Verizon stock was a decrease in the expected revenues and EPS (earnings per share).

The main reason for the decline in Southern stock was pretty much the same. Analysts expect SO’s EPS to drop 33.3% year on year.

TIL: What is the debt ceiling?

The debt limit is a cap on the total amount of money that the US federal government is authorized to borrow. It prevents the government from borrowing more than what Congress has determined and enforces restrictions on how much debt the government can incur. When the limit is hit, the Treasury Department can no longer increase the amount of outstanding debt and must rely on any cash on hand and incoming revenues to pay for its obligations. If the US Treasury exhausts its cash and extraordinary measures, the Federal government loses any means to pay its bills and fund its operations beyond its incoming revenues; thus declares bankruptcy.

Important data/ decisions that will be published next week:

The PCE inflation, Q4 GDP Growth, and Services PMI

We believe, next week will also be a consequential week.

Let’s not forget the tech layoffs; with the decision that came this week by Microsoft and Google, we saw how overstaffed the tech companies are. Here is a chart to see it:

We will see how the investors will behave after the PCE inflation, Q4 GDP Growth, and Services PMI data.

DISCLAIMER: THIS TEXT CONTAINS NO INVESTMENT ADVICE.